New York State Solar Incentives 2024 Form – Momentum Solar helps customers enroll in New York’s solar rebate and incentive programs This price range is based on 2024 reports from multiple sources. This program exempts property . The U.S. government really wants you to buy an electric vehicle (EV). That’s why it is offering a $7,500 tax credit for the purchase of some EVs.But a .

New York State Solar Incentives 2024 Form

Source : www.solar.comSolar Tax Credit By State 2024 – Forbes Home

Source : www.forbes.com2024 Solar Incentives by State | Bankrate®

Source : www.bankrate.comNew Mexico Solar Tax Credits, Incentives and Rebates (2024)

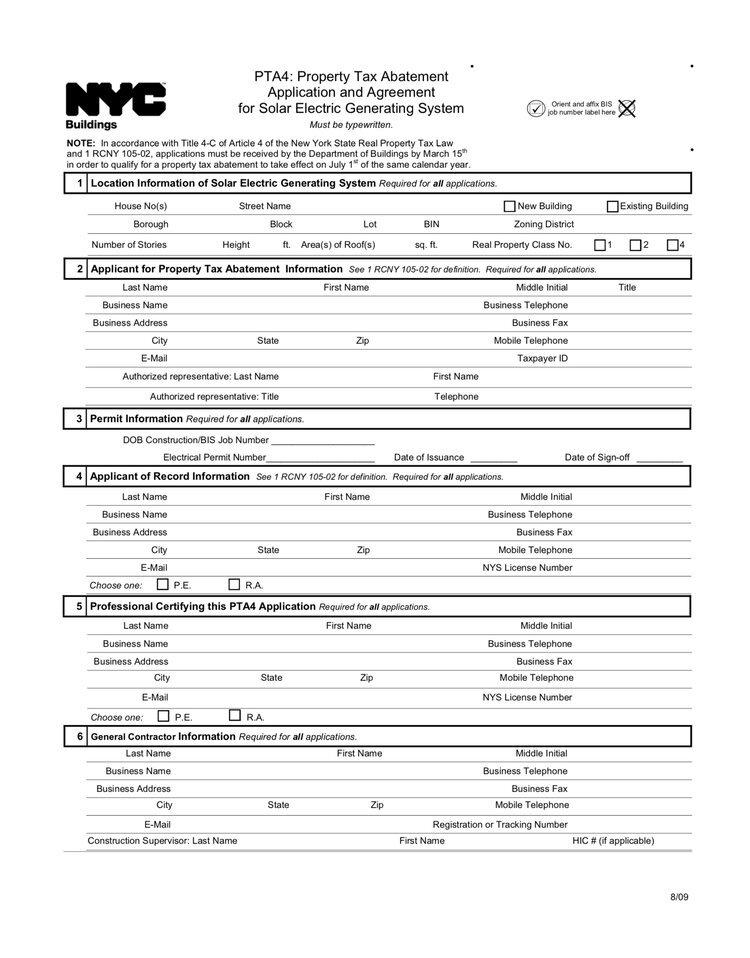

Source : www.marketwatch.comNYC Solar Property Tax Abatement PTA4 Explained [2023]

Source : www.sologistics.usVermont Solar Tax Credits, Incentives and Rebates (2024)

Source : www.marketwatch.comMissouri Solar Incentives, Tax Credits And Rebates Of 2024

Source : www.forbes.com5 New Year’s resolutions to electrify your life | Canary Media

Source : www.canarymedia.comHow To Fill Out IRS Form 5695 to Claim the Solar Tax Credit

Source : palmetto.comWyoming Solar Incentives, Tax Credits And Rebates Of 2024 – Forbes

Source : www.forbes.comNew York State Solar Incentives 2024 Form NYC Solar Property Tax Abatement Extended Through 2035. Here’s How : A journalist by trade, she started her career covering politics and news in New York’s Hudson of the United States. The state offers several tax incentives for solar energy systems, which . A new consumer protection law that will go into effect on February 11, 2024 will amend and clarify New York’s existing credit card surcharge law. The NYS Division of Consumer Protection assists .

]]>