Qualified Business Deduction 2024 Rules – Ready or not, the 2024 tax filing season is here. As of January 29, the IRS is accepting and processing tax returns for 2023. The agency expects more than 128 million returns to be filed before the . There are tons of popular tax breaks out there. Whether you’re a new car owner, a student loan payer or a retiree with high medical costs, there are some important ones to know about. .

Qualified Business Deduction 2024 Rules

Source : www.freshbooks.comFour Year End Tax Moves for Businesses | Miller Cooper

Source : millercooper.comHow did the Tax Cuts and Jobs Act change business taxes? | Tax

Source : www.taxpolicycenter.org4 year end tax moves for businesses The Forde Firm

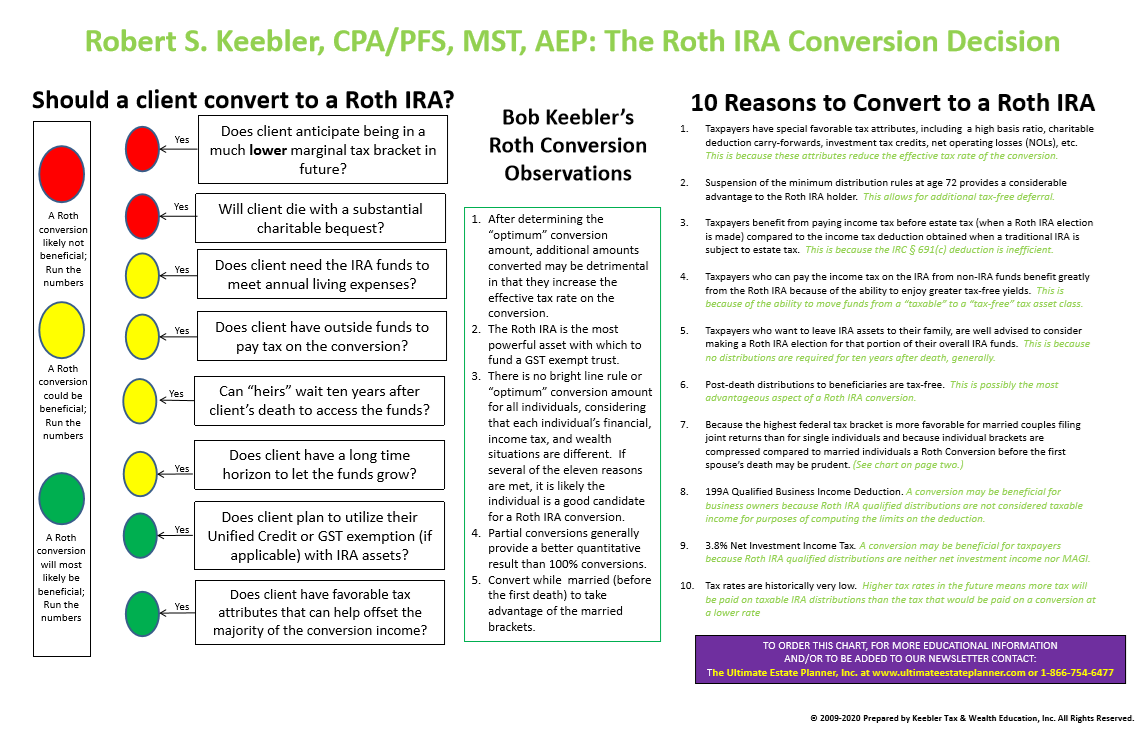

Source : fordefirm.comRoth IRA Conversion Decision Chart 2024 Ultimate Estate Planner

Source : ultimateestateplanner.comBluegrass Professional Associates | Louisville KY

Source : www.facebook.comUnderstanding Tax Law Changes and Tax Bracket Adjustments | U.S. Bank

Source : www.usbank.comT20 0221 Make Sec199A Deduction for Qualified Business Income

Source : www.taxpolicycenter.orgIRS Announces 2024 Tax Brackets, Standard Deductions And Other

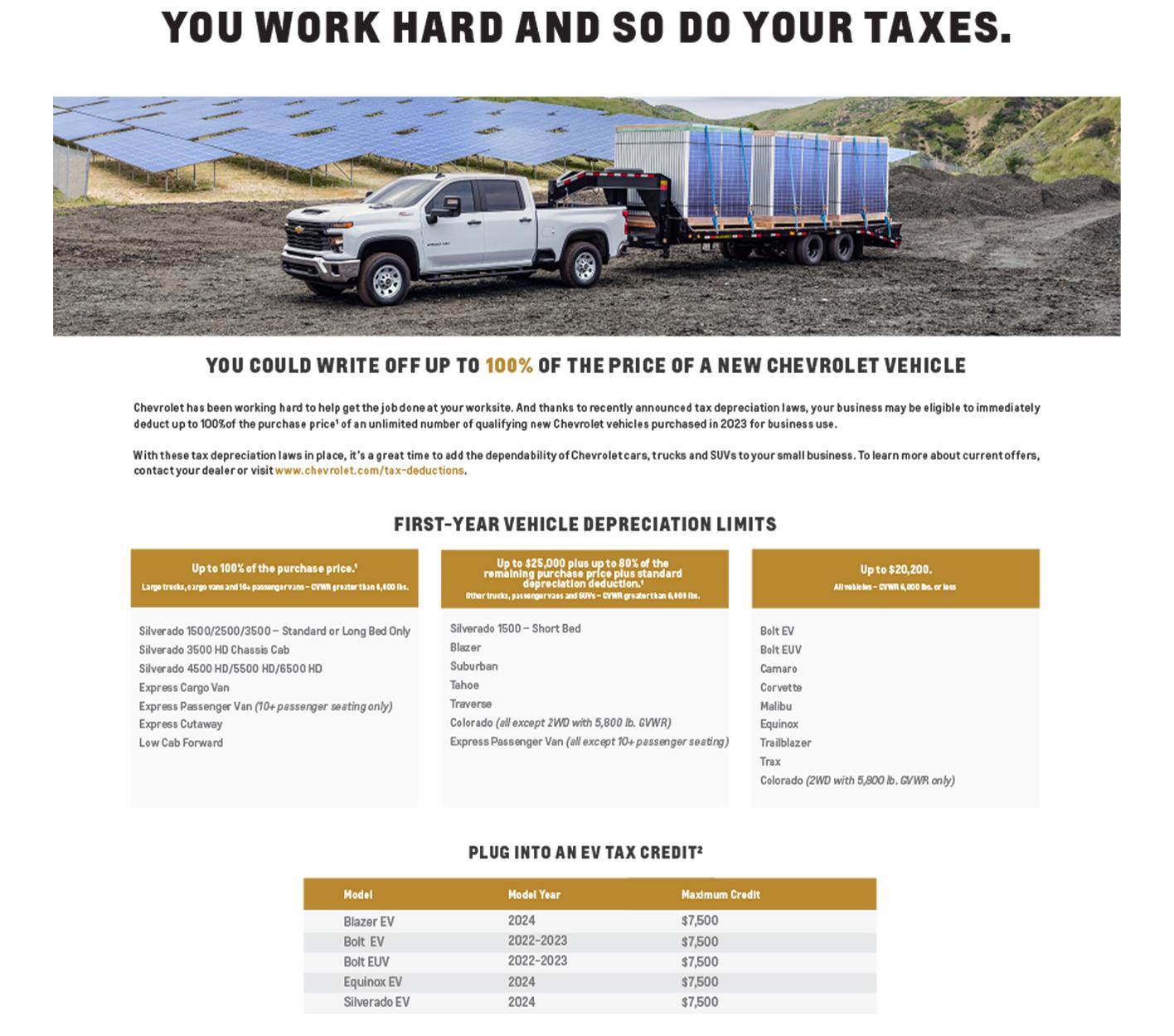

Source : www.forbes.comColussy Chevrolet is a BRIDGEVILLE Chevrolet dealer and a new car

Source : www.colussy.comQualified Business Deduction 2024 Rules 25 Small Business Tax Deductions To Know in 2024: There’s a special rule deduction and itemized deductions, pick whichever one is higher. (Small business owners and certain other people might also be allowed to deduct up to 20% of their . The TRAFW Act would increase the amount of business interest that a taxpayer This change enables taxpayers to deduct 100% of the costs of qualified property placed in service during 2023, 2024, or .

]]>